July 14, 2022

Just recently, I had an irritating customer experience with a lender in purchasing our home. In March, when they requested our paperwork to verify income, we dutifully stayed up until 11:00 pm submitting everything they needed to evaluate our financial stability. (We normally sleep at 9:00 pm!)

In June, with no word on the status of our pre-approval, they began requesting documents that we had already provided in March. We politely told them to refer to their own client portal where they had us upload the documents they were asking for. We worked hard to complete the forms in the client portal and didn’t see why we should have to duplicate our efforts sending everything through email as well. In July, this mortgage lender again requested documents that we had already uploaded in our client portal. No wonder nothing was getting done! It was clear to both my husband and I that our case was not being dealt with in the most efficient manner.

When they requested yet another time, documents we had already provided, we finally said we’re going with another lender who I know to be on top of things. This is the only time I got an immediate response, that is:

Hi Jamie

Is there something that we can do to retain you as a XXXXX customer? We are pending the final review of your income for final calculations. Please advise.

Thank you

When running your own business, consider how many choices your clients have and, by your actions, give them enough confidence to know they’ve made the right decision in choosing you.

Our new lender addresses every task promptly and even refers to me by my former military rank! That’s kind of an ego boost. In this example, the former mortgage lender carried on as if they were the only game in town, failing to realize the universe of options available for buyers today. It’s important to note:

For every client, choosing to do business with you should be their equivalent of pressing the “easy button.”

If you make the process hard, you’re just inviting them to move their business somewhere else!

July 13, 2022

As Warren Buffett’s professor at Columbia University, Ben Graham was a pivotal figure in changing Buffett’s life and views on investing. In 1934, Graham wrote the text, Security Analysis, and his simple idea that buying stocks should be thought of as buying companies flipped the “on” switch for young Buffett.

Although it’s quite dense, one golden nugget of wisdom that can be easily digested is Graham’s “secret” formula for calculating the intrinsic value of any public company. That is,

[8.5 + (2 x growth)] x earnings per share = intrinsic company value per share

So if you found a fast growing company with $2 in earnings per share with a growth rate of 10%, your equation would look like this:

[8.5 + (2 x 10)] x 2 = $57

That company would be worth $57 per share in intrinsic value to a Grahamian style investor.

Let’s take a real company, Activision Blizzard. Say we presume an 8% growth rate and take their trailing twelve months earnings per share of 3.41. Plugging into our calculation, we get:

[8.5 + (2 x 8)] x 3.41 = $83.55

Based on this, the company would be worth approximately $83.55 per share. Another helpful marker that lets us know we’re on track is that Microsoft has made an offer to purchase Activision for $95 per share. So you have to think that this calculation is at least within the ball park.

But valuation is not an exact science and that’s where the margin of safety comes in if we end up being dead wrong. Since that’s a possibility, remember: this isn’t meant to be taken as investing advice or a recommendation, but merely for educational purposes.

After calculating some intrinsic valuations yourself, do you see any other companies that could potentially be on sale?

July 6, 2022

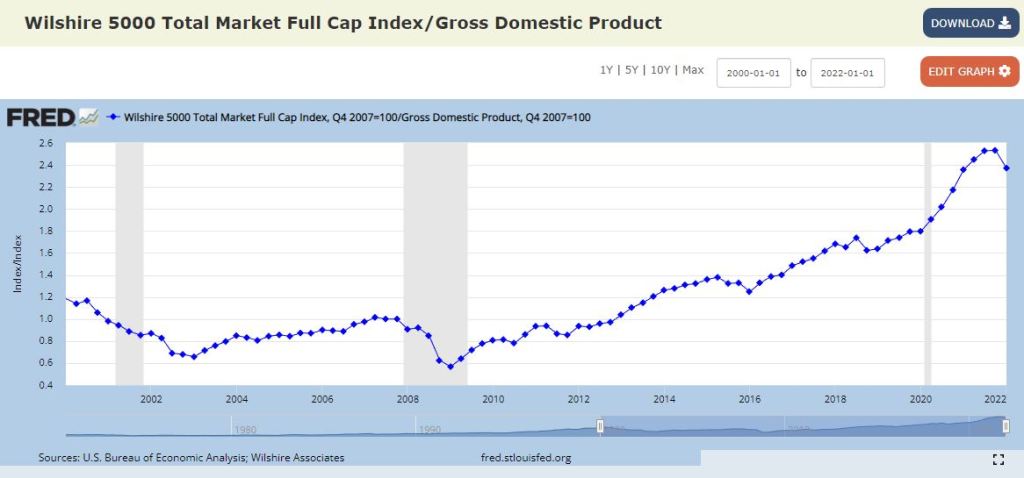

Warren Buffett has been known to use this Wilshire 5000 to GDP indicator to get a general sense of the economy. It basically shows the ratio between the equities in the Wilshire 5000 and the gross domestic product of the entire United States.

Similar to the Shiller PE, it helps to indicate how the market is going about. At a ratio of about 0.6, we were in the 2008-2009 financial crisis, a great time to buy, since the probability of companies recovering from that lowest of economic times was more likely than not. Also, we can see that after the Dot Com bubble in the early 2000s, the ratio was about 0.88. If you compare this to our current situation, where the value of the total market is said to be 2.37 times what America’s GDP is, it kind of makes you scratch your head, doesn’t it?! And that is a good thing to notice.

I once listened to a podcast where the speaker explained, if you’re ever found saying to yourself, “This doesn’t make sense,” your spidey senses should be tingling on full alert and going crazy. Something is about to happen, just happened, or is already occurring.

What do you think is occurring here?

July 5, 2022

If you’re a little bit lost in this chaos of inflation and recessionary signals, here’s one trick I use. I like to mark time by two different metrics–one of which is the above Shiller PE ratio. The Shiller PE ratio shown here depicts the price of all stocks in the S & P 500 and compares it to the inflation adjusted earnings of those stocks. Using the reference of times past, you can clearly see that the average Shiller PE since the late 1800s has been 16.95. In crazy high markets like the Dot Com era, the Shiller PE has been as high as nearly 45. It was probably not a good time to invest in tech stocks then.

There have been times of bargain. Obviously, one such period was after Black Tuesday and the Great Depression when the Shiller PE was close to 5. The baby was thrown out with the bath water; in other words, good stocks as well as bad stocks were punished as far as market price because people were so fearful of losing all their savings.

Another prime period to invest was during the 2008-2009 housing crisis where the Shiller PE sat at around 15. Today’s Shiller PE of 29.60 still shows “high” if you believe in a reversion to the mean of 16.95. This isn’t investing advice and is simply for educational purposes. Though I believe if you study the history along with this popular indicator, you might be able to come to some fruitful conclusions about what is the right time to buy or sell. And in the next post, we’ll go over the other metric, the Wilshire GDP, famously used and referred to by the Oracle of Omaha himself, Warren Buffett.

July 2, 2022

In this oft-quoted video from the BBC, Charlie Munger sums up everything you need to know about investing in 49 seconds!

One, you should only invest in things you’re capable of understanding. This is your circle of competence. There is a sweet spot of things you know versus the whole universe of what you don’t know. There are so many ideas out there that it’s possible to pursue a lifetime of investments within your sweet spot/circle of competence, however small it is.

Two, the business you’re investing in has to have a durable, competitive advantage. For example, I read once that Robert Kiyosaki was among the first to develop the Velcro “surfer wallet” but didn’t patent it’s design. So then it could be reproduced cheaply and easily in China, undercutting all of his sales, which is what eventually happened. This is the opposite of a durable, competitive advantage.

Three, it’s best to have management in place with a lot of integrity and talent. If they are short on talent, then you really need a business that even an idiot could run. But if they are short on integrity, then you need to run in the opposite direction!

Finally, you have to determine the company’s value and, in doing so, you need to give yourself a margin of safety in case your calculations are off. So if you think a banana stand is worth $100.00, then your margin of safety price would involve you buying said banana stand for $50.00.

That’s it! These four rules win the day. Everything else is just fluff, which Munger wryly jokes is all the rest of business school. Happy investing!

June 25, 2022

Sometimes it just gets handed to you on a silver platter! If you were able to attend the Berkshire Hathaway Shareholder Meeting this past May or even watch it online, you’ll know that Warren Buffett wanted to correct the record by saying he personally made the decision to purchase shares of Activision Blizzard. Then in an effort to reach everyone, he published a letter online at BerkshireHathaway.com saying the same, as well as the PRICE it was purchased at!

Now, of course, everyone must perform their own research, but it helps to know when the Oracle of Omaha is on your side when purchasing a stock and also at what price. Oftentimes, reasonable people can disagree. It’s a one pager with some generous information for the investor that pays attention!

June 22, 2022

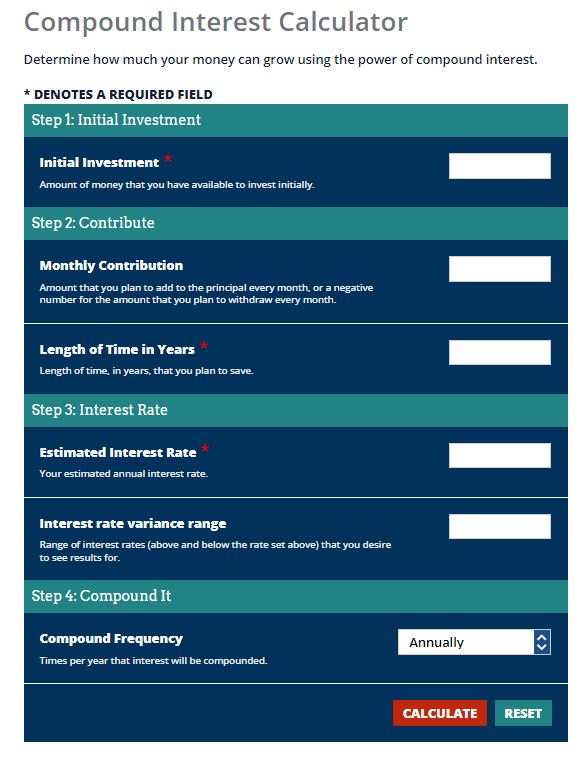

Perhaps the biggest joy to an investor is compounding. Compounding is the secret ingredient in the alchemy of transforming a little into a lot. I want to introduce to you a tool that has been SO FUN for me to use over the years. It’s helped me dream, plan, and keep me on the right path towards my investing goals. It’s the “Compounding Interest Calculator” from Investor.gov. Here’s a snippet of the calculator that I just grabbed from today.

As you can see, the calculator enables you to make it a very personal exercise. Whatever money you have to start out with–mine was $900 when I was 19 years old!–enter that in first. All the other inputs are pretty straightforward–what you’ll commit to contribute monthly, how many years you’ll save, what rate of return you typically get, compounded annually. I usually don’t put anything in the interest rate variance range because really, who knows?

Then when you hit “calculate”, it gives you a graph and chart of exactly how much money your investments should make each year. So for the past 16 years, I’ve used this same (old and faded!) chart that I first printed out to make notes on and mark whether I’m still on track to my investment goal. It’s fun to think of the things you will buy and do with that money. Plus, you can have immediate feedback on how well your plan is working. I recommend it to anyone that’s taking investing seriously.

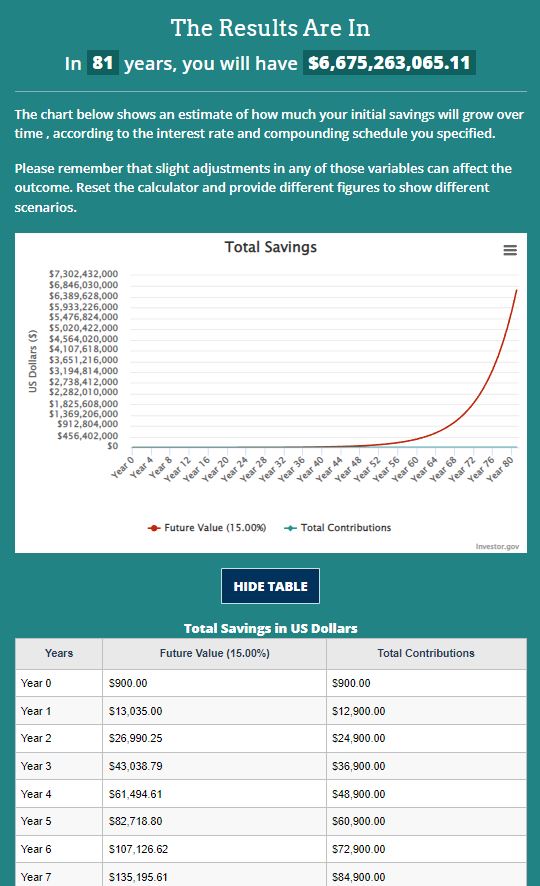

So for this example, I put $900 as the initial investment with $1000 in monthly contributions. Then I presumed the interest rate to be 15% for the next 81 years (living to 100!). And just take a look at the result . . . $6,675,263,065.11!!! Below the graph, you’ll see a chart of the amounts you’re expected to have year by year if things go smoothly (just know, the years will definitely not be smooth, but probably VERY lumpy). Put a check mark when you’re on track or ahead; write some corrective notes if you’re not.

Once again, isn’t compounding interest amazing?! What numbers are you putting in?

June 21, 2022

“I am not attuned to this market environment, and I don’t want to spoil a decent record by trying to play a game I don’t understand just so I can go out a hero.”

Warren E. Buffett

The May 29, 2022 marks the end of an era. Buffett decides to begin liquidating his partnership which has been successful for so long. To his credit, they have a relatively large fund with no new (good) ideas to capitalize on and Buffett can’t, in good conscience, sit around “hoping to ‘get lucky’ with other people’s money.”

He gives his partners 3 options: (1) they can take his recommendations for other managers’ funds whom he’s negotiated with to have no minimum entry requirement for partners, (2) partners can receive cash or marketable securities, OR (3) partners can remain in Diversified Retailing and Berkshire Hathaway plus a number of other non-transferable, illiquid investments which probably won’t produce income for a long time. Which would you choose?

We all know which option ended up being the best after over half a century (and counting!) of track record to prove it! This is thankfully not the last letter we receive from Warren E. Buffett.

June 20, 2022

In the January 22, 1969 letter, Buffett details his spectacular and somewhat unexpected results from 1968. A stunning 58.8% gain versus the Dow’s 7.7%! That is, a monetary gain of $40,032,691 for the partnership. Taking a walk down memory lane, Buffett recounts starting the partnership in 1956 with a total of $105,000 of which he contributed $100. Fast track to 1969 and the value of the partnership is a gigantic $104,429,431 of which the Buffett family and partnership staff have $27 million. 13 years of great returns but Buffett ends the letter by reiterating how the market circumstances have changed, there’s a little nostalgia for the past, and new ideas are at an all-time low. Nonetheless, he applauds his “crowd” for going through the journey with him.

June 19, 2022

The November 1, 1968 Buffett Partnership letter is a short one calling for prompt submission of Commitment Letters. Still, he puts out some extraordinary numbers, a gain from $4.8 to $8.8 million on Diversified Retailing and a +15% lead on the Dow. Despite they’re trying, he’s not letting any new members in because that might harm the results of his current partners.

June 18, 2022

In the July 11, 1968 Buffett Partnership letter, Buffett starts describing how the market is going sideways with “chain-letter type stock-promotion.” Tons of money is being made aggressively with the use of “bold, imaginative accounting.” Meanwhile, Buffett cautions his partners that not as much money will be made by his style of permanent ownership of controlled businesses, which only provide satisfactory, not spectacular rates of return. Nevertheless, BPL achieved an overall gain of 16% versus 0.9% on the DOW. Not bad!

June 17, 2022

“When I am dealing with people I like, in businesses I find stimulating (what business isn’t?), and achieving worthwhile overall returns on capital employed (say, 10 – 12%), it seems foolish to rush from situation to situation to earn a few more percentage points.”

Warren E. Buffett

In the January 24, 1968 Buffett Partnership Letter, Buffett boasts some huge returns. 35.9% versus the 19% gain for the DOW. But he shrugs it off saying, “So did everyone else.” In 1967, “it rained gold” and people were making speculative gains with wild returns that may have surpassed even the partnership. Buffett gave his partners an out if they wanted in on these bets and $1.6 million of partner money flowed out. Boy, were they wrong!

Regardless of the October announcement of “reduced objectives,” Buffett’s Generals increased by 72%! Enough to make your mouth water. There’s a bit of foreshadowing here when a partner asks if the partnership is winding down. He answers with an emphatic “no” but later on it becomes the only thing you can do when you no longer understand the rules of the game or can’t win.

June 16, 2022

“This does not reflect any market judgment on my part; it simply means I can’t find any obviously profitable and safe (from a long-term value standpoint, not a short-term quotational one) places to put the money.”

Warren E. Buffett

The November 1, 1967 letter is short and seemingly mundane, but it does have a terribly important point.

Someone new to Buffett and his substantial cash piles over the decades could easily be led to believe that he “times the market.” In this letter, he states that $36 million of the partnership funds will basically remain steady even if the market shoots up. Instead of this being a result of market timing, which he has no interest in as the above quote states, it is the by-product of not being able to find any good, rational deals. This enigma has always been the root cause of his cash hoards in periods of irrational exuberance. Coincidentally, that behavior seems to time the market very well! Causing Buffett to stay on the sidelines when speculation abounds.

June 15, 2022

“I will not abandon a previous approach whose logic I understand (although I find it difficult to apply) even though it may mean foregoing large, and apparently easy, profits to embrace an approach which I don’t fully understand, have not practiced successfully and which, possibly, could lead to a substantial permanent loss of capital.”

Warren E. Buffett

In the October 9, 1967 Buffett Partnership letter, Buffett finds himself slightly out of step with the rest of the market. For one, speculation is not a game that he knows how to play nor does he want to. Also, the capital base, having ballooned to $65 million, is starting to become a drag on performance.

Buffett explains that he will still remain conservative, staying in businesses which may not be the most spectacular, even though there may be other high flying stocks out there. Unwavering in his approach, he states, “I am likely to limit myself to things which are reasonably easy, safe, profitable and pleasant.” Given that, he doesn’t fault partners if they decide to withdraw their money and chase that yield. I really hope none of his audience fell for the allure of a fast market here and just stuck with him!

June 13, 2022

The July 12, 1967 Buffett Partnership letter is interesting because it’s here that Buffett explicitly notes how much of a drag the Berkshire Hathaway textile business is beginning to be on the portfolio. Nonetheless, the results bounced back after a rough start to the year where the partnership trailed the Dow. And in fact, he makes a comment about how the rising market makes most everyone look good. When doing the usual work of comparing various investment funds with highly paid managers, he states, “The tide continues to be far more important than the swimmers.”

Finally, in pure Buffett form, he calls attention to his poor performance in the beginning of the year, the hallmark of why he is so great at establishing trust with his partners! That also sets up the major relief that comes when he lets his investors know they’ve recovered to the tune of +9.6% over the Dow. Well played, Mr. Buffett!

April 26, 2022

“We will not go into businesses where technology which is away over my head is crucial to the investment decision. I know about as much about semi-conductors or integrated circuits as I do of the mating habits of the chrzaszcz.”

Warren E. Buffett

In the January 25, 1967 Buffett Partnership letter, Buffett celebrates the 10th year of the investment partnership, and what a decade it’s been! Oh, to be 36 years old and outperforming the Dow by 36 points! Wowza! To his credit, he admits its amazing and unrepeatable.

He also talks about a timeless idea in investing. That is the circle of competence. It’s important to invest in what you know, the things that lie squarely within your circle of competence. And you can expand your circle of competence by acquiring more knowledge and learning, but you must not fool yourself into thinking that everything is within your circle of competence.

For example, as a restaurant owner, I feel comfortable dissecting securities like Texas Roadhouse or Chipotle. I know the key performance indicators that would demonstrate good management like same store sales, labor productivity, or food cost gaps. But I would definitely not feel comfortable nor do I have any specialized knowledge in Bitcoin. I stay away!

It’s amazing how far honoring a few simple time-tested ideas can take you. At 36 years of age, Buffett had amassed a total of $54,065,345 for himself and his investors. I am the same age and needless to say, I have some catching up to do! What are some simple principles that you live by?

April 10, 2022

In the November 1, 1966 Buffett Partnership letter, Buffett does the typical asking for partner commitments and establishing the Ground Rules. Because of his now-famous rate of return and the fact that the partnership is now closed to other investors, Buffett has to caution his partners against accepting other people’s money to donate to the partnership on their behalf. One of my mentors always said, ”When you can achieve that level of return, people will swim through shark-infested waters to find you.” It’s true!

Buffett also discusses his task of valuing Berkshire Hathaway and H-K as control situations. They are currently beating the Dow by a large margin, but that might change as time wears on. Same goes for the ”Generals – Relatively Undervalued” securities. And as the Dow goes even lower, it might be necessary to reevaluate Berkshire and H-K’s valuations as well.

April 9, 2022 – Conservatism

“I believe that conservatism is more properly interpreted to mean ‘subject to substantially less temporary or permanent shrinkage in value than total experience.”

Warren E. Buffett

In the July 12, 1966 Buffett Partnership letter, he celebrates achieving a return of 8.2% for the partnership while the Dow lost 8.7% – more than achieving their goal of a 10 point margin on the Dow. Buffett, again, compares the other investment funds who he believes have mistaken conservatism with mere “average experience,” i.e. performing in concert with the unmanaged Dow.

Buffett offers a better definition. Rather, conservatism should be that if money is being made, a good manager should make about the same, but if money is being lost in a market, the manager’s guidance should cause the loss to be less for his fund.

Buffett also reiterates Ground Rule No. 6, no market timing! No one can tell the future and he suggests those partners who believe that’s a requisite for investing might need to find another partnership! Finally, he recommends the text, “The Intelligent Investor,” from his great mentor, Benjamin Graham, as a reference for stock market fluctuations.

April 8, 2022 – The Tao of Nick Sleep

For those of you that haven’t heard of Nick Sleep, he is the former manager of Nomad Investments, a fund that achieved Buffett-like returns in their 14 years of operation. Sleep and his partner, Qais Zakaria, earned over $2 billion in gains for their investors by riding on the coattails of business juggernauts like Costco, Amazon, and ASOS.

Mr. Sleep is a former landscape architect turned investment fund manager who was heavily influenced by the notion of “quality” espoused by Robert Pirsig’s “Zen and the Art of Motorcycle Maintenance.” If you ever think that Buffett’s methods are exhausted or no longer applicable in our modern world of nanosecond high-frequency trading, Nomad’s success is testament to the opposite! Enjoy reading his letters below and check out his charitable foundation, I.G.Y., which seeks to foster collaboration among scientists to solve the world’s most pressing problems.

April 7, 2022

“7. We diversify substantially less than most investment operations. We might invest up to 40% of our net worth in a single security under conditions coupling an extremely high probability that our facts and reasoning are correct with a very low probability that anything could drastically change the underlying value of the investment.”

Warren E. Buffett

The January 20, 1966 Buffett Partnership letter details a whopping 47.2% overall gain compared to the Dow at 14.2%. It is over $12 million in additional capital – a major victory! As is typical, Buffett likes to bring attention to the fact that the highly paid managers receiving around $10 million in fees have not even come close to his performance, much less the Dow’s. Only Lehman has beaten the Dow in 1965 by a mere 4.8%. “What is their yardstick?” he asks. Corporate managements have to measure themselves, but there seems to be no similar system for managers of other people’s money.

Ground Rule #7 is also emphasized in this letter. This will become a key characteristic of Buffett’s entire investing career and teachings. Diversification – especially in portfolios “encompassing one hundred stocks” – is not logical. Once he identifies the high probability/low probability investment mentioned in Ground Rule #7, the most logical thing is to go all-in, that is, NOT to diversify. This may result in some “sour” years but over the long term, it should produce a greater margin of superiority. And the proof is in the pudding!

April 6, 2022

The November 1, 1965 Buffett Partnership letter would be pretty mundane except here is the 1st mention of “Berkshire Hathaway, Inc., a publicly-traded security.” The partnership acquires a controlling interest in the textiles manufacturer to be valued “at yearend at a price halfway between net current asset value and book value.” This is history in the making!

April 5, 2022

“If our performance declines to a level you can achieve by floating on your back, we will turn in our suits.”

Warren E. Buffett

As usual, in the July 9, 1965 Buffett Partnership letter, Buffett compares the Dow, 4 large investment companies, and the Partnership in their performances for the year. The 4 large investment companies consistently underperform the Dow and at the very best, match it. In previous letters and in this one, Buffett references the analogy that if the water rises, you shouldn’t congratulate the duck for rising as well (hence, the nautical theme in the quote above).The accolades come, instead, from “flapping your wings” when appropriate.

This year, Buffett and the Partnership flapped their wings to achieve a 9.6% advantage in a relatively unchanged year for the Dow. The other investment companies merely rose with the waters. Buffett explains that if that is ever the case with your investments, even the Partnership, you really should be looking for some place else to park your money.

April 4, 2022

“If a 20% or 30% drops in the market value of your equity holdings (such as BPL) is going to produce emotional or financial distress, you should simply avoid common stock type investments.”

Warren E. Buffett

The January 18, 1965 Buffett Partnership Letter is a long one making several more distinctions to the Buffett philosophy. The quote above is one of the first mentions of the type of temperament required to invest in common stock. You really need to face a 20-30% drop with a certain level of stoicism if you’ve truly done your research and made a rational bargain buy. Remember, the profit is in the purchase!

In this year, performance was strong, a gain of 27.8%, but it wasn’t their greatest year since they didn’t beat the Dow by at least 10 points. This, as stated previously, is more difficult to do when the Dow is advancing. Even so, Buffett trounces the highly paid management who barely kiss the Dow. Their lackluster results can be explained by the institutional imperative. That is, if you maintain the status quo, no one gets fired. It’s better to lose by orthodox methods than to win by unorthodox ones in that game. So they conform, aim for average, and employ irrational diversification methods; the returns show it!

Buffett encourages his partners to evaluate their holdings without bias and also to evaluate themselves as investors, without bias. He also makes clear that his aim is to maximize gains, not to minimize taxes. You’d rather have gains to pay taxes on after all!

April 3, 2022

“All investment managements should be subjected to objective tests, and [. . . ] the standards should be selected a priori rather than conveniently chosen retrospectively.”

Warren E. Buffett

In the July 8, 1964 Buffett Partnership letter, Buffett discusses the situation he called attention to earlier. That if the Dow is advancing, it’s difficult to get an edge on it. In fact, he cites the statistics for very highly paid investment managers who have not beaten the Dow. The Buffett Partnership is slightly ahead before fees and slightly behind after. He suggests that investors should study their investment results (or investment manager’s results) as closely as they study their investments.

The “generals” that the partnership invests in now include 3 companies. They have been purchasing some over the course of a year, which speaks to the patience and clear criteria for purchase that Buffett has for these acquisitions. He sees these companies improving earnings and increasing asset values while the market price of the stock is largely unchanged. This leaves him with two options. The market could reevaluate it’s pricing or he could eventually gain total control of the company; either is fine. It’s fun when you have a lot of ways to win and not many ways to lose!

April 2, 2022

“I heard rumors regarding a sellout to Union Oil of California, I never act on such information [. . .] that’s somebody else’s business, not mine.”

Warren E. Buffett

In this January 19, 1964 Buffett Partnership letter, Buffett celebrates another year where they bested the Dow by more than 10%. Though he cautions that an 18.7% advantage is probably not sustainable over the long term.

The letter repeats a lot of things from previous letters. Once again, he explains that the Dow is a good rule of thumb because active managers who get paid in excess of “$7 million” do not often beat it. He also explains how the partnership has been able to beat them all while still being more conservative! The joys of compounding get another nod as well as explanations for generals, workouts, and controls. In the appendix, there is an in depth overview of a workout situation as well as a general, the sale of Dempster at a very nice gain. Not only that, they were able to find their “man” in Harry Bottle, which sparks the beginnings of the Berkshire method of operation.

We learn from Dempster that patience is key in stocks with no glamour. Which leads to his next point that you need to wait to measure a manager’s performance, at least 3 years, because there is no timeline for when a general will realize its true value. Another rule is they will plead the 5th on any investment discussions to preserve their advantage. Finally, you can’t be afraid of appearing too conservative and outdated for not swinging at bad investment pitches (or not relying on rumors before making investment decisions).

April 1, 2022

In the December 26, 1963 Buffett Partnership letter, Buffett talks about some tax preparation tips for his limited partners. You can see that his conservatism applies in this as well. He advises his partners to pay their actual tax paid for the previous year, just to be safe. He underlines the following, “If your estimate for the current year is the same as the actual tax paid for the preceding year, you cannot be penalized for underestimating.” Chances are he’s speaking to investors who have never seen +32% returns before and just wants them to understand the tax implications. He ends by emphasizing that his is a “conservative investment philosophy.”

March 31, 2022

In this November 6, 1963 Buffett Partnership letter, Buffett reminds his partners of some end of the year tasks and deadlines. He also asks everyone to review the Ground Rules of his partnership so they can get an overall sense of his long-term strategy.

Then he inadvertently discusses what will later become the foundations of his future Berkshire success with Dempster as the exemplar. That is “built-in profit” due to a ”bargain purchase price” as well as excellent management with a long term view. He praises Harry Bottle as the equivalent of an executive home run. Buffett even allows Harry to become a limited partner in his partnership, which is fast becoming an exclusive club to get into! And it’s the returns that tell us why this is so.

With a gain of 32% at the end of October 1963, almost 13.2% ahead of the Dow, membership in this club is producing some sweet and rarefied results. Buffett is careful to caution that it could be premature to call victory with 2 months still left in the year. Also, he wants his investors to know these results are not typical and he would still be happy with a slightly lesser margin over the Dow. Reason being, those results have a greater chance of being maintained for the long-term.

March 30, 2022

“Investment decisions should be made on the basis of the most probable compounding of after-tax net worth with minimum risk.”

Warren E. Buffett

In the July 10, 1963 Buffett Partnership letter, Buffett describes the partnership’s reason for being, that is to (1) compound funds at a (2) better-than-average rate with (3) less exposure to long-term loss of capital. That could be every investor’s goal and you could do very well.

He then saves the sweetest news about Dempster for last. In a master stroke, the Buffett Partnership acquired 71.7% of Dempster for $1,262,577.27. But get this, in a small safe deposit box at the Omaha National Bank, Dempster held stock certificates worth $2,028,415.25! With the business assets as well as their share of the stock at $1,454,373.70 (71.7% share), it does not take a genius to figure out that this is an OUTSTANDING deal. And that makes me happy because I’m not a genius!

This also shows the kind of certainty you can achieve by doing your due diligence in investing. He describes this level of accounting as the “fingers and toes method” versus a “prayerful reliance that someone will pay me 35 times next year’s earnings.” I prefer the fingers and toes method too!

Way back when I was in law school, I worked in the campus bookstore. At the end of the year, students would try to sell back their books only to find that their text would no longer be used next semester. So they just threw them in the recycle bin! The important thing to realize was these books were not worthless. They could be sold to any number of other law school students across the nation who were still using the texts. So I asked my boss if I could fish these books out of the recycle bin and sell them online. The result – I made about $750 extra every semester doing this which really helped my finances back then. And in what was my own little master stroke, I ended up selling one of the books back to my OWN boss at the campus bookstore!

That’s pure profit. The “fingers and toes method.” Have you ever had a “sure thing” like this in your own investments or business life?

March 29, 2022

“Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good results. The better sales will be the frosting on the cake.”

Warren E. Buffett

From the January 18, 1963 Buffett Partnership letter, I love this quote because it very clearly states the money is in the buying, NOT the selling. Margin of safety is what it’s all about. So that should make the investor feel comfortable in knowing he or she has total control.

In this letter, Buffett repeats a LOT of principles from previous ones, hence it’s 13 pages long. But that’s why I think he’s such a good teacher for me, not only does he say the most important points over and over (also speaks to his consistency), he says it in a way that is easier for me to understand versus the Ben Graham texts.

Here, Buffett refreshes his partners on generals, work-outs, and controls. He also gives the breakdown of how they land in the portfolio. Then on pg. 7, he describes the use of options in “securities sold short totaling some $340,000.” Not many people realize that Buffett uses derivatives and gains some pretty chunky premiums on them to increase the velocity of his money. He also describes the use of short-term leverage in some of his fairly-certain-to-succeed workouts. Many investors are also surprised to know that Buffett uses leverage from time to time.

Where you have a comfortable edge over odds, you can reasonably go all-in like that. If you’re interested in learning more about edges and odds, I’d recommend learning about the Kelly Formula online or skimming through William Poundstone’s book, “Fortune’s Formula.” It details the entire story behind the creation of the Kelly Formula and it’s varied uses in both gambling and investing.

March 28, 2022

The December 24, 1962 Buffett Partnership letter is very short and simple. It’s explaining some tax filing information to the partners. It also mentions the partnership’s performance relative to the Dow. While the Dow was down 8.5%, the partnership was up by 11.5%! I think he’s being a playful by saying the “margin of superiority” has diminished. That is still a fantastic advantage.

But again, it’s reiterating his consistent message from previous letters that they expect to perform phenomenally when the Dow is down and struggle to keep up if the Dow is roaring.

March 27, 2022

“Six-months’ or even one-year’s results are not to be taken too seriously. Short periods of measurement exaggerate chance fluctuations in performance. [. . .] Investment performance must be judged over a period of time with such a period including both advancing and declining markets.”

Warren E. Buffett

In today’s $cratch Pad, I reviewed the Buffett Partnership letter from July 6, 1962. Buffett reiterates portions from his last letter in January saying how the Dow is a good benchmark. But in this letter, he goes a step further and demonstrates how he’s been beating it. May seem a little weird to celebrate, but Buffett describes a – 7.5% rate of return compared to the Dow’s -21.7% as “one of the best periods in our history.” And he isn’t wrong!

He goes into describing how one “growth” fund had done very well from 1959-1961, causing a rush of investors who then experienced a significant decrease in their investment in the period that followed. Because of the propensity to judge investment performance too soon, the fear of missing out, and not testing performance in both declining and advancing markets, a great many more holders of the fund experienced the dregs versus the heights of this fund’s performance. So the quote highlighted above is instructive to avoid a permanent loss of capital similar to that.

Another very unique characteristic to note about the partnership is that Buffett placed a 6% return “hurdle” on himself before he could receive his allocation. So his investments had to pay off by a certain amount before he could call it “good” and take his share. This is distinguished from other investment funds which allocate fees to themselves regardless of wins or losses and therein, make a killing. Again, just shows how highly Buffett regarded his partners so their trust in him would be warranted. A lot of value investors have copied this fee structure in their own funds to show the same deference.

March 26, 2022

“You will be right, over the course of many transactions, if your hypotheses are correct, your facts are correct, and your reasoning is correct. True conservatism is only possible through knowledge and reason.”

Warren E. Buffett

In the January 24, 1962 Buffett Partnership letter, Buffett reviews the principles of how his partnership runs. He makes clear how his performance should be evaluated in relation to the DOW and that he hopes to do at least 10 percentage points better at all times, up and down. So far, he’s been winning, making his partners over a 45% return in the last year!

This is also the famous letter where Buffett defines his methodology of stock selection consisting of generals, workouts, and controls. Generals are undervalued securities that don’t require any interference on his part. There’s no timeline, he just waits for the value to become fully realized somewhere between his purchase price and the “fair value to a private owner” in order to make a profit. Work-outs are securities “whose financial results depend on corporate action.” Examples of work-outs are mergers, liquidations, reorganizations, and spin-offs which lead to the unlocking of value by management. Finally, controls are where the partnership has a large stake in the business and a “say” in how the company operates, able to influence its results for the benefit of shareholders.

It is important to note the strong undertones of conservatism and mitigation of risk here. So many investors think securities go hand-in-hand with risky behavior, a “no pain, no gain” mentality. Others believe that risk is mitigated by purchasing blue chip stocks or government bonds. They too have their inherent risks, as Buffett states, bonds led to decreased buying power. And no matter how “blue” a chip stock is, you can’t buy it for an infinite price.

The true strategy for reducing risk and increasing certainty are these less-touted generals, controls, and workouts that don’t track the general market and typically do better. And also having a margin of safety that allows you to be off on valuation but still have a huge potential for appreciation.

How do you figure this out? As he is quoted above, “over the course of many transactions,” with the use of correct hypotheses, facts, and reasoning, “you will be right.”

March 22, 2022

“[O]ne year is far too short a period to form any kind of an opinion as to investment performance [. . .] My own thinking is much more geared to five year performance, preferably with tests of relative results in both strong and weak markets.”

Warren E. Buffett

Today’s $cratch Pad notes come from Buffett’s Partnership letter dated July 22, 1961. In it, he explains how his shareholders missed him and wanted more communications! So he changed the frequency of his letters to twice a year instead.

The most important thing to note is the above quote and how he cautions his readers against the desire to think in shorter terms given the more frequent communications. I mentioned before (and I think Buffett mentions in a later letter) that you should be able to “Rip Van Winkle” your investments and wake up 40 years later unaffected just because they are that good/wisely chosen. And it should also not matter whatsoever what the ticker says moment by moment, hence the preference for just the annual letter.

If you don’t invest for yourself, the weight given to 5-year performance over 1 year or shorter is also important for anyone choosing an investment advisor. One year could be a lucky year. Whereas a 5-year span of both hot and cold markets is more telling of investment prowess.

March 20, 2022

“Our bread-and-butter business is buying undervalued securities and selling when the undervaluation is corrected along with investment in “special situations” where the profit is dependent on corporate rather than market action.”

Warren E. Buffett

My scribbles on the January 30, 1961 Buffett Partnership letter. It looks like someone has made a note of Graham and Dodd’s book, “Security Analysis” as well as the seminal work, “The Intelligent Investor.” While I’ve read both books, I think Buffett’s letters are much easier to understand. Some people swear by reading these texts. For me, it’s fine that Graham changed Buffett’s life and Buffett changed mine.

So in this letter, Buffett talks about the fantastic investment that he referenced in the 1960 letter which took up 35% of the partnership pie. It’s a company called Sanborn Map that was doing very well with their near monopolistic position in the map industry. Things changed and the map business went kaput. But what many investors failed to realize was that while the map business was struggling, during its heyday, maps didn’t require a lot of upkeep or capital expenditure, so the revenues that came in were spent on stocks and bonds. Later on when the map business economics became evident, the company’s share price drooped and did not reflect the almost $7 million investment portfolio AND the map business along with it. Hence, it was undervalued!

Buffett saw this as a great opportunity to buy out the existing shareholders at fair value, separate the two arms of Sanborn Map, reallocate capital in the portfolio, and rejuvenate the map business. It was a win-win proposition for everyone involved. He highlights a lot of principles, which I tried to capture with some notes, but I like that he returns to the above quote. The long-term strategy is finding undervalued companies and correcting the undervaluation, especially if all that’s required is a kick in management’s rear. This is a strategy of base hits. Sanborn, however, was a home run and not to be passed up!

March 19, 2022

“I would rather sustain the penalties resulting from over-conservatism than face the consequences of error, perhaps with permanent capital loss, resulting from the adoption of a “New Era” philosophy where trees really do grow to the sky.”

Warren E. Buffett

Notes on the Buffett Partnership letter dated February 20, 1960. When they deviate from a system of investment that has a proven track record over half a century, pundits always try to say, “This time it’s different,” or “It’s the new way of doing things versus the tired, old method that no longer works.” There have been so many instances when sometimes highly regarded investors said Buffett’s principles were outdated or over-conservative. Unfortunately, trees never “grow to the sky” and, in the stock market, there are consequences for believing that they do.

The way that Buffett thinks about investing is not inherently risky, especially with the systematic way he selects opportunities. Then he makes a clear preference for being too conservative versus risking a permanent capital loss. It is this permanent loss of capital that you REALLY want to avoid!

Consider this. Say you have $2.00 and you lose $1.00 of your investment. You have to make a 200% return on your money to get back to your starting point! That level of return is astounding for even a very astute investor. Better to avoid the loss in the first place.

So he rests in knowing there’s no need to adopt the “New Era” tactics but, instead, trust in what actually makes money with the least amount of risks to his partners’ funds.

March 18, 2022

“A program of investing in such undervalued well protected securities offers the surest means of long term profits in securities.”

Warren E. Buffett

These are my scribbles on the Buffett Partnership letter dated February 11, 1959. While it’s certainly not everything that can be said about the letter, I picked apart some of the key pieces until I ran out of room to write. I thought the most impactful statement was the quote from above.

If I break it down, it seems like 5 parts . . .

(1) It’s an investing “program” – a rational, systematic way of being or acting that provides the “surest means” of financial success.

(2) Since value is distinct from price, an attempt is made to calculate the true value of a security then determine whether it’s on sale or “undervalued.”

(3) The underlying companies are “well protected” or they have competitive advantages that allow them to assume the #1 (or close to it) position in their industries for the foreseeable future.

(4) You can be relatively certain of success if you maintain this rational and disciplined type of investing program.

(5) Securities and investing can only be thought of in the long term. There are no short cuts or get rich quick schemes with as much certainty as this approach.

Do you agree? What other hidden gems did you find in this letter? Thanks for reading!